Unionbank Go Rewards Visa Card Launched Today

Tuesday, June 27, 2023

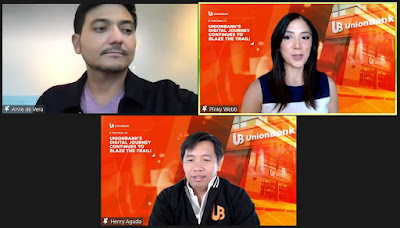

UnionBank Confirms Working On Metaverse, Announced Milestones on 13th ETalk Tales

Wednesday, December 15, 2021

James Illeto VP for Corporate and Media Reputation Management of UB says "This is our last E Talk tales and is about gratitude for everyone who supported us this year. What an exciting year it has been with Unionbank, we received awards, has been the most recommended bank in digital. We can't wait to unrap more."

Ms Pinky Webb says "2021 has been a banner year for Unionbank, with life changing projects, it redefined what banking is today."

Henry Aguda the Senior EVP and Chief technology Operations Officer for UB says "Unionbank has blased the trail in digital. The pandemic has created this shift, the way we interact, transact in the financial sector. We always had the forward looking view and we have thrived during the hard times. In 2020, we focused on our digital strengths, we increased by 300 percent in customers and is still continuing to 2021. We're seeing the light at the end of the tunnel by Q2, even if we had to face lock-downs. I'm glad to say we are ending the year on a high. Only Unionbank has been given a digital bank license as an actual bank. We now have a San Pedro Innovation Campus, a major step for us that we have it during at a time of crisis. We have superior innovation, registering 21 patents, 18 more in the process supporting inventors, think tanks, and more. We also have network and branch transformation with 100 percent uptime, data center connectivity, 150 branches transformed of over 195 branch nationwide. We also have Instapay 2.0, leading the way of transacting electronically in the marketplace. We also have the SME Banking Platform so MSME's have a way of IFC Investments, and banking apps that answer their banking needs. We also have our tech advocacy about wealth management, it is educational support and trained 101 digital transformation specialists, with thought leaders in government included. We also have UBX platform signups, where thousands of MSME's got their help. Customer accounts also increased, phenomenal performance even during 2021's pandemic. Our customers, employees and stakeholders have always been there, thank you!"

Arvie De Vera the Co Founder and CEO of Union Digital says "We wanted to have the company as a digital bank. We are now a tech company and a bank. What differentiates us is that we exist in the cloud. Our infrastructure is not as huge, but because of it, our services are lower priced. With digital, people can be assesed by transaction data. It allows us to imagine a future with little or no fees through blockchain. Send money in minutes, where customers can get the solution in a few taps. The future is for banks to become digital, but it is a very complicated process. The newly transformed Unionbank, UBX and Union Digital did a hybrid approach, to embrace it, to adapt to it. It can address the needs of a digital world. Fintech has enormous growth, blockchain adoption has grown 36 times and open finance has been prioritized by Banko Sentral. The Philippines is the 4th fastest digital economy in the world, and is expected to reach higher in the next few years. The P2E has also grown, 40 percent of it is from the Philippines. The Filipino is driving it again. Our country remains the top in social media usage worldwide, even Ecommerce adoption and the opportunity to grow is great. Unionbank is the only publicly listed bank that is granted a digital bank license. We also championed open finance in the country, it enables companies to work together better. Our API's can be used in real time, in a secure manner. It supports the industry and empower its growth. At our heart, we give what they want, what they need in security and proper governance. We have solid leadership, one who understands how to be first movers."

They want to continue to be ahead of the curve, follow customers where they are heading to. They don't want to lose the personal touch, to have everything they do revolve around the needs of the customer. Right now, UB is actually working on things like the METAVERSE (they actually have a branch now but are still working on it) and is optimistic that they would be able to deliver their services not just for their customers now, but the future. EON is growing, Unionbank Digital is also growing, and people want digital capability even before the pandemic, it's not gonna close down. Keep focusing on the customer, and everything else will follow. They need speed, decisiveness, whilst being customer centric.

Insurance Crisis in the Philippines Addressed on 11th Unionbank E-TalkTales

Friday, September 03, 2021

Woke up super early for this but had my cup of coffee and forgot to login promptly for the 11th edition of the E-Talk Tales hosted by Unionbank. Guest speakers were UBX President and CEO John Januszczak, Coherent CEO John Brisco and Chubb Deputy Regional President for Asia Pacific Glen Browne.

They discussed the Philippines low insurance coverage and how much Filipinos have not seen the benefits of having one. John Januszczak says "It's not easy for most people to have a basic understanding of how it can be valuable for them. Providers should device a way to make it easier for them to discover it. You have to make them relate, have it personalized and not make it complicated. These days, some products are being shown the same way as it was 50 years ago. It should be easy to understand for customers, agents and advisors. Mobile has been a great enabler in the Philippines and we have to leverage that more so for internet connection, I believe there are creative ways to do it. We're bringing products to make the transaction faster, to make it easier for them to buy insurance. There is indeed a lot of upside in getting insurance."

John Brisco, CEO of Coherent says "What we do is make it easy for them to create products by providing data, help them interact wtih insurance and UBX without hitches, make it accessible for everyone. We want to help integrate them into the UBX ecosystem and act as the facilitator between them and UBX. We want it to be as seamless as possible."

Glen Brown adds "Insurance is seen as something extremely complicated, when we first partnered with UBX, what we could do here was different from other countries. We'd learned across Southeast Asia that we need to bring the best solutions to more that 50 Million signups in the region. There really has been a change in the last 2-3 years. Chubb continues to provide world-class products that fits in that experience and Coherent is bringing the technology that makes that happen. It's quite unique."

With the way things are, there are lots of room to grown in the insurance business in the country. You just have to have the right partner to make it work.